how to calculate my paycheck in michigan

Enter any overtime hours you worked during the wage period you are referencing to calculate your total overtime pay. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay.

Florida Income Tax Calculator Smartasset Com Property Tax Income Tax Tax

For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000.

. Calculates Federal FICA Medicare and withholding taxes for all 50 states. These calculators are not intended to provide tax or legal. Paid by the hour.

Some of your employees may have pre-tax benefits such as FSA HSA or retirement savings accounts. See the results for Payroll calculator mi in Michigan. Dont want to calculate this by hand.

How to calculate taxes taken out of a paycheck. Dont want to calculate this by hand. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

Michigan law Michigan Vehicle Code MCL 2572174 requires dealers to apply for title and registration on behalf of their customers. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. Federal labor law requires overtime hours be paid at 15 times the normal hourly rate.

The PaycheckCity salary calculator will do the calculating for you. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Michigan. For instance a person who lives paycheck-to-paycheck can calculate how much they will have available to pay next months rent and expenses by using their take-home-paycheck amount.

For salaried employees. Switch to salary Hourly Employee. The best payroll services will include expert help through a dedicated department as well as tax support as well.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. Switch to Michigan salary calculator. This Michigan hourly paycheck calculator is perfect for those who are paid on an hourly basis.

If you pay your employees twice a month then you have 24 pay periods per year. Supports hourly salary income and multiple pay frequencies. Important Note on Calculator.

Michigan Overtime Wage Calculator. To use our Michigan Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. SmartAssets Michigan paycheck calculator shows your hourly and salary income after federal state and local taxes.

This number is the gross pay per pay period. Secretary of State - On-line Plate Fee Calculator is available for your convenience. Paycheck Calculator The State Of Michigan.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. The results are broken up into three sections. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Michigan.

Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. Calculate your Michigan net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Michigan paycheck calculator. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Divide the employees annual salary by the number of pay periods per year. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52. Enter your info to see your take home pay.

When a customer needs a new plate the dealer must calculate the plate fee and record this information on the RD-108. How to Calculate Salary After Tax in Michigan in 2022 Optional Choose Normal View or Full Page view to altr the tax calculator interface to suit your needs Choose your filing status. Switch to hourly Salaried Employee.

Michigan Salary Paycheck Calculator Results Below are your Michigan salary paycheck results. Figures entered into Your Annual Income Salary should be the before-tax amount and the result shown in Final Paycheck is the after-tax amount including deductions. Subtract any deductions and payroll taxes from the gross pay to get net pay.

The filing status affects the Federal and State tax tables. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. This free easy to use payroll calculator will calculate your take home pay.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator. This number is the gross pay per pay period.

Figure out your filing status work out your adjusted gross income Total annual income Adjustments Adjusted gross income calculate your taxable income Adjusted gross income. State Date State Michigan. Many companies right now offer automatic solutions that work together with your time plus automatically update typically the hours that workers work according to what the clock exhibits.

Switch to Michigan hourly calculator. After a few seconds you will be provided with a full breakdown of the tax you are paying. In Michigan overtime hours are any hours over 40 worked in a single week.

Change state Check Date General Gross Pay Gross Pay Method. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. How Your Paycheck Works.

It should not be relied upon to calculate exact taxes payroll or other financial data. The PaycheckCity salary calculator will do the calculating for you. Subtract any deductions and payroll taxes from the gross pay to get net pay.

Calculating your Michigan state income tax is similar to the steps we listed on our Federal paycheck calculator.

An Example Of A W 4 Form And About How To Fill Out Various Important Sections Best Tax Software Tax Refund Proposal Writer

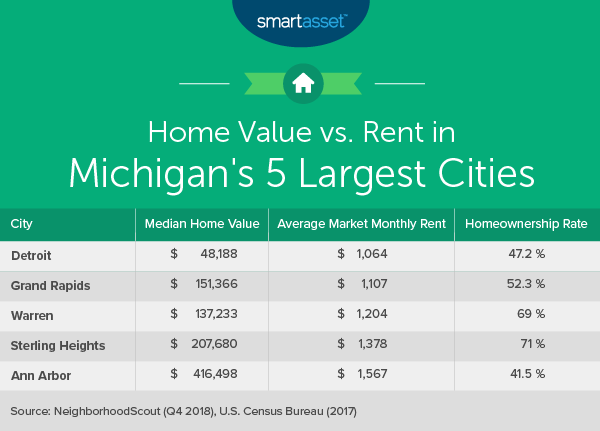

The Cost Of Living In Michigan Smartasset

Michigan Marvin Faq Michigan Unemployment Help Career Purgatory

Michigan Medicaid Income Limits 2021 Medicaid Nerd

2020 Michigan Good Food Virtual Summit Launch Session Msu Mediaspace

Michigan Salary Calculator 2022 Icalculator

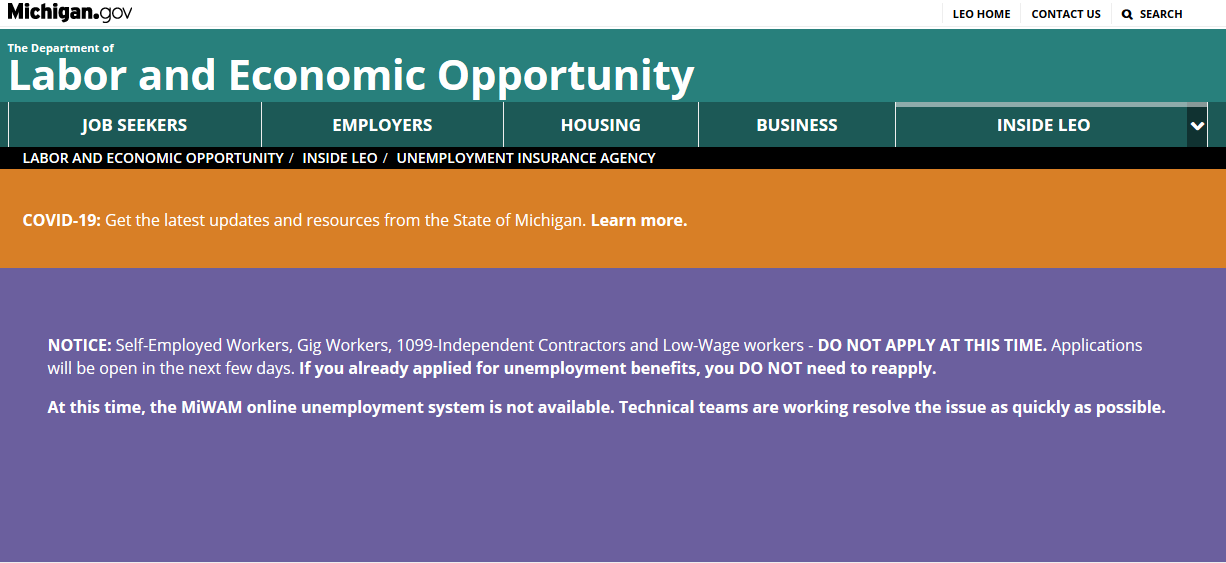

Labor And Economic Opportunity Can A Person Work Part Time And Still Collect Ui Benefits

Michigan Paycheck Calculator Updated On Tax Year 2022

Paycheck Calculator Michigan Mi Hourly Salary

Michigan Wage Calculator Minimum Wage Org

2021 Benefits Wellness Virtual Expo Human Resources Western Michigan University

Michigan Income Tax Calculator Smartasset

Truthful Unemployment Claimants Won T Have To Repay Benefits Despite Michigan Error Whitmer Says Mlive Com

State Of Michigan Taxes H R Block

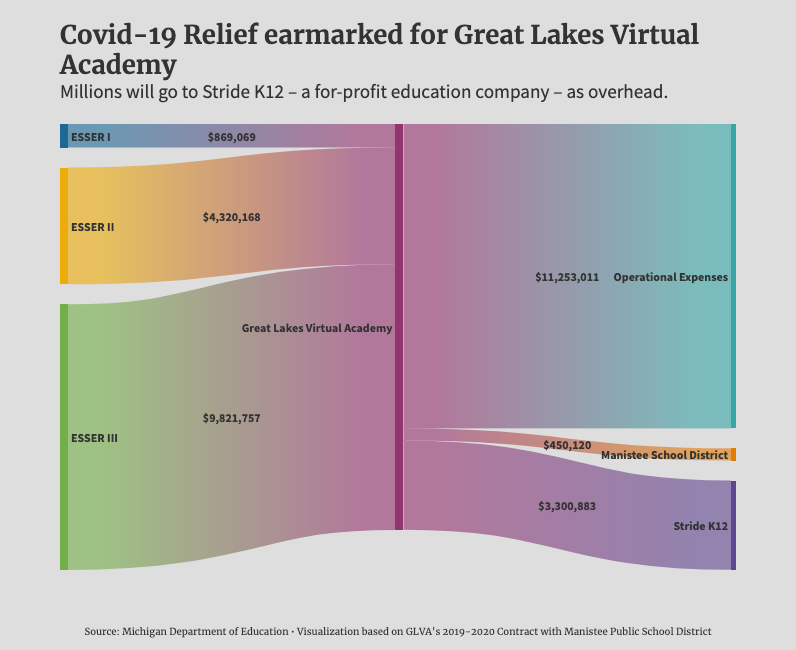

Michigan Pandemic Relief Dollars Went To For Profit Cyber Schools Covid 19 Record Eagle Com